An Unbiased View of Mileagewise - Reconstructing Mileage Logs

Table of ContentsThe Facts About Mileagewise - Reconstructing Mileage Logs UncoveredSome Known Details About Mileagewise - Reconstructing Mileage Logs Not known Details About Mileagewise - Reconstructing Mileage Logs The smart Trick of Mileagewise - Reconstructing Mileage Logs That Nobody is DiscussingGet This Report on Mileagewise - Reconstructing Mileage LogsMileagewise - Reconstructing Mileage Logs for DummiesSome Known Details About Mileagewise - Reconstructing Mileage Logs Not known Facts About Mileagewise - Reconstructing Mileage Logs

This consists of prices such as gas, upkeep, insurance policy, and the lorry's devaluation. For these expenses to be taken into consideration insurance deductible, the automobile must be utilized for company functions.Only gas mileage straight related to business can be subtracted. Deductible driving mileage refers to the miles you cover throughout business procedures that you can deduct from your taxes.

In between, diligently track all your company trips keeping in mind down the starting and finishing analyses. For each journey, record the location and business purpose.

The 7-Minute Rule for Mileagewise - Reconstructing Mileage Logs

This consists of the complete service mileage and total mileage accumulation for the year (service + individual), trip's day, location, and objective. It's important to tape activities without delay and maintain a coexisting driving log detailing day, miles driven, and service objective. Right here's how you can improve record-keeping for audit functions: Begin with making sure a careful gas mileage log for all business-related traveling.

Some Of Mileagewise - Reconstructing Mileage Logs

Those with considerable vehicle-related costs or special problems might benefit from the actual expenditures approach (simple mileage log). Please note choosing S-corp status can change this estimation. Eventually, your chosen approach needs to line up with your specific monetary objectives and tax obligation scenario. The Standard Mileage Rate is a measure provided yearly by the IRS to establish the deductible costs of running an automobile for organization.

There are 3 methods: To make use of the journey setting on an odometer, simply press the odometer's "trip" switch up until it displays "Trip A" or "Trip B". Constantly remember to reset prior to each brand-new trip for precise gas mileage recording.

Get This Report about Mileagewise - Reconstructing Mileage Logs

Compute your complete organization miles by using your begin and end odometer readings, and your recorded service miles. Precisely tracking your precise mileage for business journeys aids in confirming your tax deduction, specifically if you choose for the Standard Mileage technique.

Maintaining track of your mileage manually can require diligence, however bear in mind, it can conserve you money on your tax obligations. Record the overall mileage driven.

The Facts About Mileagewise - Reconstructing Mileage Logs Revealed

(https://www.openlearning.com/u/tessfagan-snah4h/)Timeero's Fastest Range function suggests the quickest driving route to your workers' destination. This attribute improves efficiency and adds to set you back savings, making it a necessary possession for services with a mobile workforce. Timeero's Suggested Route function even more enhances liability and efficiency. Workers can compare the suggested course with the actual course taken.

Such an approach to reporting and compliance streamlines the typically intricate task of handling mileage costs. There are several benefits connected with making use of Timeero to monitor mileage. Let's take a look at some of the application's most significant functions. With a relied on gas mileage tracking tool, like Timeero there is no requirement to fret about mistakenly omitting a date or piece of information on timesheets when tax time comes (mileage log).

Excitement About Mileagewise - Reconstructing Mileage Logs

These added verification steps will certainly keep the Internal revenue service from having a reason to object your gas mileage records. With accurate gas mileage monitoring innovation, your staff members do not have to make harsh gas mileage price quotes or even worry concerning gas mileage expense monitoring.

Unknown Facts About Mileagewise - Reconstructing Mileage Logs

Many mileage trackers allow you log your trips by hand while computing the range and compensation amounts for you. Numerous also included real-time journey tracking - you require to start the app at the beginning of your trip and stop it when you reach your last location. These apps log your beginning and end addresses, and time stamps, in addition to the total range and reimbursement amount.

What is the very best mileage tracker app? The ideal gas mileage tracker application for you will certainly depend on your needs and the local needs of what you must Going Here be logging for your gas mileage reimbursement or deductions. We recommend looking for an app that will track your gas mileage automatically, log all the needed details for trips such as the moment, destination and objective, and give you with gas mileage reports you can use for your compensation.

The 10-Minute Rule for Mileagewise - Reconstructing Mileage Logs

Patrick Renna Then & Now!

Patrick Renna Then & Now! Julia Stiles Then & Now!

Julia Stiles Then & Now! Mason Reese Then & Now!

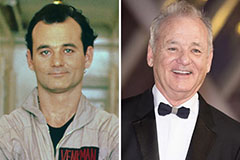

Mason Reese Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now! Teri Hatcher Then & Now!

Teri Hatcher Then & Now!